Prices may be Cooling but on a Global Liveability Index, Australian Capital Cities are Hot; With Four Ranked in the top 12 out of 140 Cities.

Australian cities remain some of the most liveable in the world according to The Economist Intelligence Unit’s Global Liveability Index in 2018. Four of Australia’s capital cities ranked in the top 12 out of the 140 cities.

The index saw Melbourne rank the highest in Australia in 2nd place, performing 0.9 points better (at 98.4) than in 2017, despite being displaced by Vienna after seven consecutive years in the top spot. Sydney moved up to 5th place, from 11th. Adelaide claimed 10th place and Perth retained its position at 12th. For house and apartment price growth, Hobart continued to be the best performing capital city, followed by houses in Canberra and Adelaide.

With an established risk-adverse lending environment, overall capital values fell this quarter in Australia, dominated by the cooling Sydney and Melbourne markets, following double-digit growth in recent years. Given both cities have strong economies and significant population growth, it’s likely by the end of 2019, most new stock will be absorbed and price growth will return.

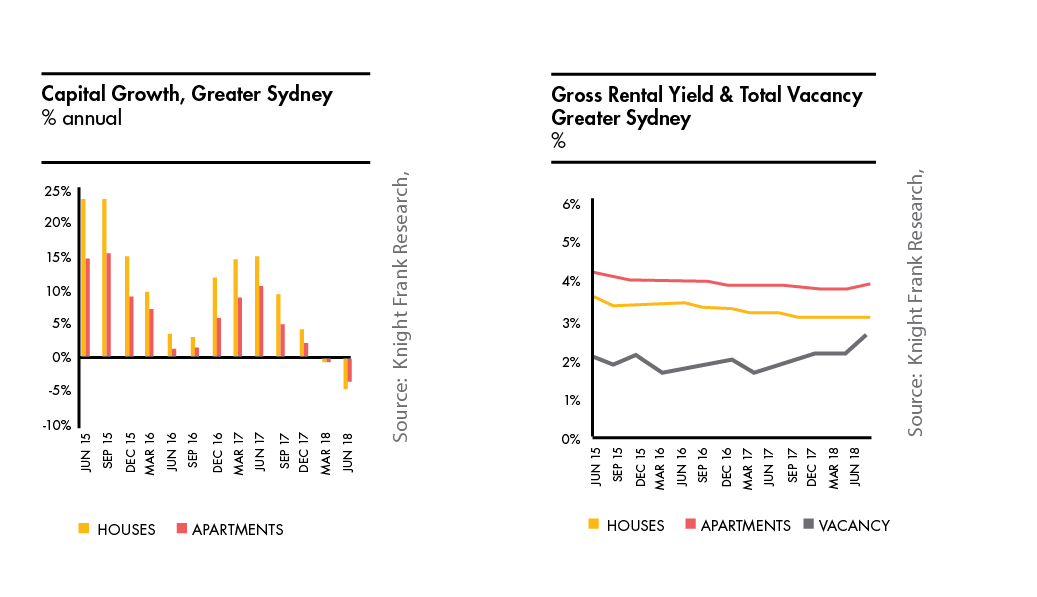

Sydney

Annual

CAPITAL GROWTH AUCTION CLEARANCE

Houses -4.5% Apartments -3.5% 67.6% for week ending 12 August

SALES VOLUMES GROSS RENTAL YIELDS

Houses -11.8% Apartments -20.4% Houses 3.10% Apartments 3.9%

AVE DAYS ON MARKET TOTAL VACANCY

Houses 64 days Apartments 66 days 2.7% as at June 2018

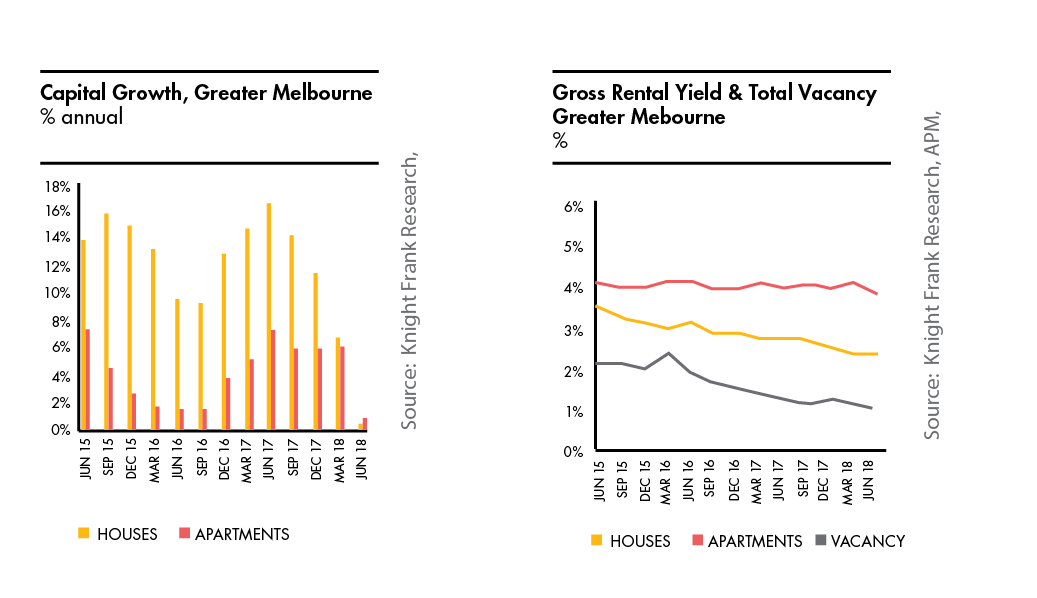

Melbourne

Annual

CAPITAL GROWTH AUCTION CLEARANCE

Houses 0.5% Apartments -0.9% 69.9% for week ending 12 August

SALES VOLUMES GROSS RENTAL YIELDS

Houses -11% Apartments -16% Houses 3.10% Apartments 4.3%

AVE DAYS ON MARKET TOTAL VACANCY

Houses 50 days Apartments 77 days 1.9% as at June 2018

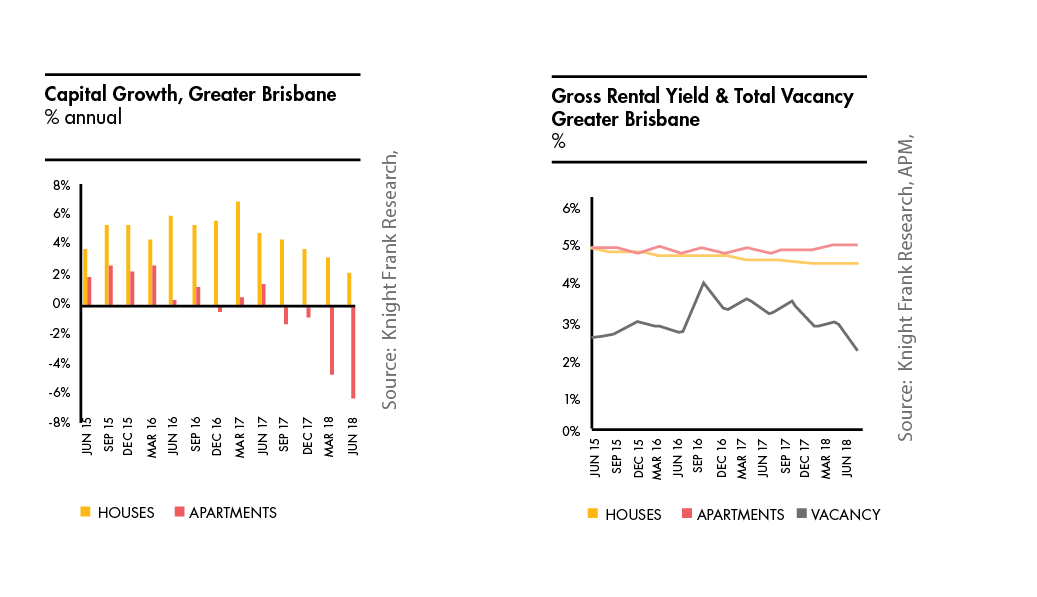

Brisbane

Annual

CAPITAL GROWTH AUCTION CLEARANCE

Houses 2.0% Apartments -6.4% 43.8% for week ending 12 August

SALES VOLUMES GROSS RENTAL YIELDS

Houses -16.1% Apartments -24.4% Houses 4.6% Apartments 5.10%

AVE DAYS ON MARKET TOTAL VACANCY

Houses 77 days Apartments 124 days 2.3% as at June 2018

Knight Frank LLP is the leading independent global property consultancy. Headquartered in London, Knight Frank has more than 14,000 people operating from over 413 offices across 60 countries. The Group advises clients ranging from individual owners and buyers to major developers, investors and corporate tenants.

Michelle Ciesielski

p | +61 2 9036 6659